Planning & Forecasting

Integrated

Business Planning

Why integrated financial planning is necessary

It is not unusual for many (especially small and medium-sized) companies to have separate strategic corporate management and financial planning. In most cases, only a one-year profit plan can be presented, sometimes supplemented by a separate liquidity forecast.

However, in a dynamic economic environment characterized by pandemics, war and environmental regulations, it is insufficient for financial management to look only at the monthly business analyses. Nor is it possible to forecast how cash flow will develop in the coming months on the basis of the BWA alone. Thus, the basis for entrepreneurial decisions is missing.

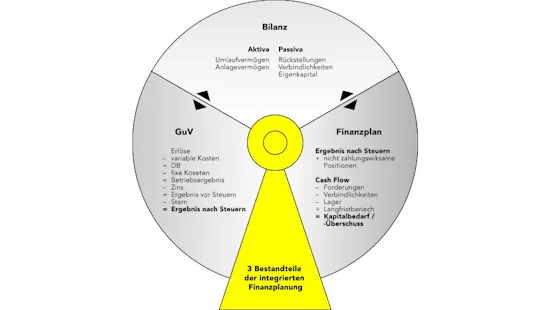

Integrated financial planning should be seen as a closed system that links the income statement with the balance sheet and cash flow statement in a bidirectional manner. It is therefore not only more informative than a one-year forecast, but also enables much better liquidity planning and optimization of your working capital.

In times of crisis, the impact on earnings and liquidity can be seen immediately and you can take countermeasures at an early stage. In addition, an integrated financial plan enables banks, stakeholders, lenders and capital providers to better assess your level of liquidity.

Integrated financial planning is a mandatory prerequisite for transparent finances and effective management of the company.

THREE AREAS OF INTEGRATED FINANCIAL PLANNING

Profit Planning

Balance Sheet Planning

Liquidity Planning

COMPLEXITY OF PLANNING

We know the challenges of our clients in their financial planning

SPEED

High effort in preparation and execution

Coordination and coordination take too long

Plans are outdated at the time of adoption and therefore useless

PRECISION

Lack of confidence in resultsRigid plans with hard targets and no room for maneuver

Sub-plans are not networked

DATA

Lack of transparency about the origin of data

Lack of automation in the provision, consolidation and presentation of data

WHO NEEDS INTEGRATED FINANCIAL PLANNING?

Disruption through new products, business models and technologies, as well as the growing volatility of the markets due to pandemics, war and other external factors makes it essential for companies to have transparency about profitability, liquidity and finances.

Integrated business planning provides a 360° view of the current situation and possible future scenarios. This allows CFOs to identify financing gaps at an early stage and to make better decisions.

Added values of integrated financial planning

high planning quality

simple planning

securing profitability & liquidity

high level of controllability

Transparency for ceditors

CREATION OF PLANNING SCENARIOS

Integrated financial planning is the basis for corporate management and provides transparency for your figures.

Our Offer to you

We support you in linking your financial planning with each other as well as with the detailed plans from the business department. The high level of integration improves management planning accuracy and decision making.

1. Step

Analysis

2. Step

Framework

3. Step

Implementation

4. Step

Conclusion

Contact